Is Pausing Your Pension Contributions Worth It? Navigating the Cost-of-Living Crisis for Young People

- Brogan Morris

- Apr 9, 2024

- 3 min read

In recent times, the cost-of-living crisis has become an ever-looming concern for many young people. From soaring rent prices to the relentless rise in grocery bills, it's no secret that making ends meet has become increasingly challenging. In the face of these financial pressures, some young individuals are considering pausing or even halting their pension contributions, as a means of easing immediate financial strain. However, while this may seem like a viable solution in the short term, it's essential to consider the long-term repercussions of such a decision.

The Temptation to Pause Pension Contributions

As they grapple with mounting expenses and stagnant wages, the idea of freeing up some extra cash by pausing pension contributions can be all too appealing. After all, why lock away money for retirement when there are pressing financial obligations to address today?

The Long-Term Impact

While it's understandable to prioritise immediate financial needs, it's crucial to recognize the long-term impact of pausing pension contributions. Retirement may seem like a distant milestone, but the reality is that it creeps closer with each passing year. By halting pension contributions, young individuals are essentially robbing their future selves of financial security.

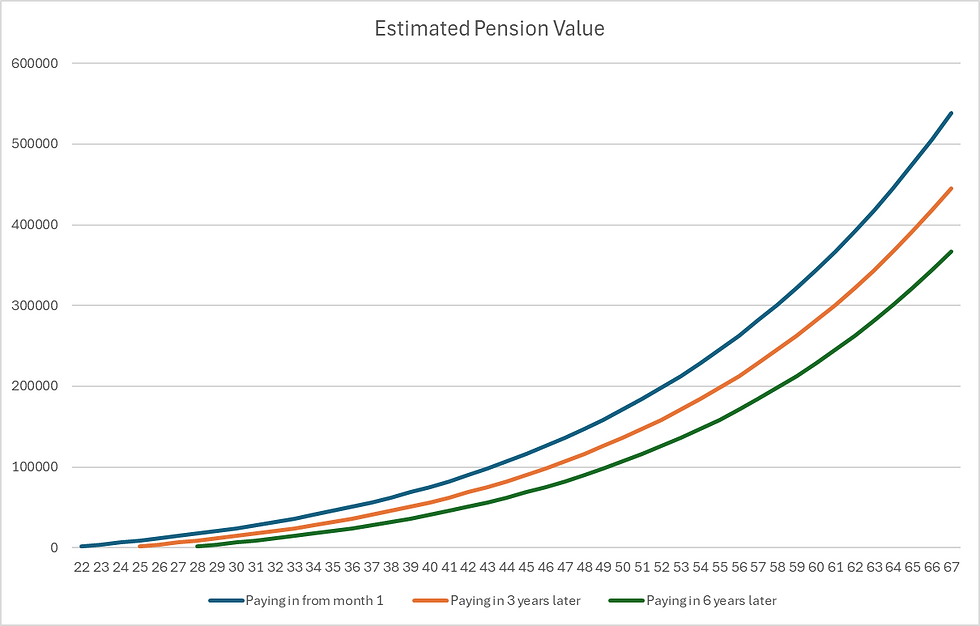

One of the most significant advantages of starting pension contributions early is harnessing the power of compound interest. By investing money over an extended period, individuals can benefit from exponential growth over time. Even small contributions made in youth, can snowball into substantial savings by the time retirement rolls around. Pausing contributions disrupts this compounding effect, ultimately diminishing the potential growth of retirement savings.

A pension is a long-term investment not normally accessible until age 55 (57 from April 2028 unless the plan has a protected pension age). The value of your investments (and any income from them) can down as well as up which would have an impact on the level of pension benefits available.

It is suggested that a person who began working on a salary of £25,000 a year in 2020 and paid the standard monthly auto-enrolment contributions (5% employee and 3% employer monthly contributions) from the age of 22 could amass a total retirement pot of £538,311,000. Opting out for three years would reduce your retirement pot by £92,000 and for six years, £171,000.

Mitigating Financial Strain Without Sacrificing Retirement Security

While the cost-of-living crisis presents undeniable challenges, there are alternative strategies for mitigating financial strain without sacrificing retirement security. Rather than pausing pension contributions altogether, you can explore options such as adjusting contribution levels or seeking financial guidance to optimize your budget. Additionally, exploring other areas of expenditure for potential savings can provide relief, without compromising long-term financial goals.

In the face of the cost-of-living crisis, it's essential for young people to adopt a forward-thinking mindset. Whilst the temptation to alleviate immediate financial pressures may be strong, it's crucial to consider the broader implications of such decisions. By maintaining pension contributions, even during challenging times, individuals are investing in their future financial wellbeing and laying the groundwork for a secure retirement.

The cost-of-living crisis presents formidable challenges for young people striving to achieve financial stability. By maintaining a commitment to pension contributions and exploring alternative strategies for managing financial strain, young individuals can navigate the cost-of-living crisis, while safeguarding their financial future. After all, retirement may seem distant now, but it's a milestone that deserves attention and preparation, even amidst the storms of today's economic climate.

If you have any questions about your pension please contact one of our advisers today.

0116 299 3000

Comments